Let’s set the scene

Financial Planners stand smack bang in the middle of the financial planning process. At any one time they may dealing directly with the following (but not limited to):

- Existing clients

- Potential clients

- Staff

- Owners in their business

- Managers in their business

- Business development managers

- Product development managers

- Referral partners

- Auditors

- Insurers

- Landlords

- Lenders

And, of course, they work closely with the mighty Paraplanner. The Paraplanner is one of the most valued cogs in the advice machine. They help make the whole process as quick and as painless as possible, but all too often the Paraplanner-Planner relationship is a point of friction.

As with most processes that are not running smoothly, it comes down to a misunderstanding about roles. We’re not talking about the Paraplanner’s role in terms of the list of tasks they do, but rather the value that they provide.

You see, Financial Planners have a whole series of problems they need to solve. By the time they require an advice document, they are neck deep in the advice process and all sorts of things have gone right, wrong and sideways already. They’re counting on a professional to help them out with this particular part.

The problem

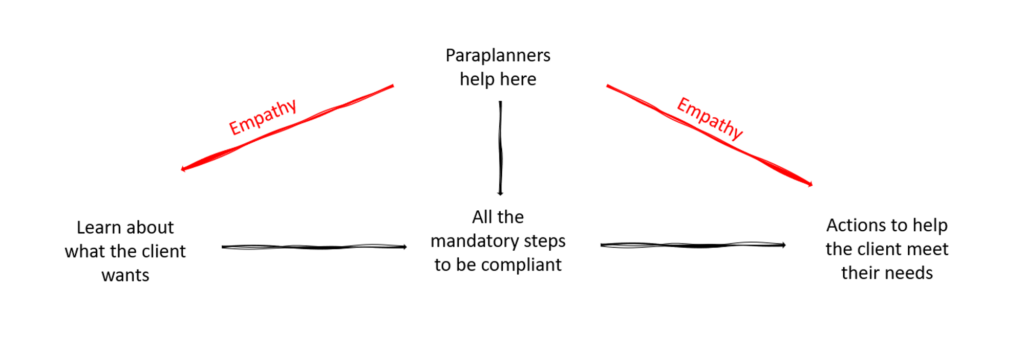

The financial adviser is trying to get their client in a better position. This should be the priority each and every time they provide advice. An advice document is not an essential tool to move one person from where they are now to somewhere else for the better, but it is a mandatory one based upon current law.

It is this dichotomy between the mandatory documentation and the purpose of financial advice that creates the tension.

An easy fix is for the paraplanner to realign their mission to be the same as the financial adviser. Instead of an advice document being the goal, the goal now becomes how the paraplanner can assist the Financial Adviser in getting their client in a better position. They become the Adviser’s problem solver.

This subtle change in viewpoint creates powerful effects over time. Each email, phone call, keystroke and output can be viewed through a new lens. When problems arise, they can conquer it together instead of the paraplanner creating a document in isolation and the adviser looking after the client.

No advice document exists in a vacuum. It is the hard work of many prior interviews, phone calls, data collection, analysis and instruction.

This shared responsibility for the process and the outcome allows everyone to be equally accountable for the skills they bring to the table. It allows the Paraplanner to be more involved in the whole process, and strengthens the Paraplanner-Planner relationship.

The empathetic Paraplanner

When our lens extends out past our role and we see the advice documentation process from the eyes of the financial adviser, we gain empathy. Empathy is often viewed as a feeling or process in order to help someone else, but you can also benefit from it because of a gained understanding. Employing empathy for the financial adviser allows you to see it from their side, which can provide valuable information to help achieve the client’s goal.

The more information you are armed with, the greater your work becomes and the stronger your working relationships grow. The outcomes of enriching the Paraplanner-Planner relationship with empathy are purely positive!

By adding empathy into the advice process, the role of Paraplanner is reimagined. It doesn’t require additional time, just a refocus and redirection of some of your energy. Learning to add empathy is a skill that will serve you forever as a Paraplanner.